The 9-Second Trick For Ach Payment Solution

The RDFI uploads the return ACH data to the ACH network, along with a reason code for the mistake. A return may be refined likewise as a result of different other reasons like a void account number etc. ACH repayments can serve as an excellent option for Saa, S companies. Right here are some essential points to remember when selecting ACH for your Saa, S: Although the usage of paper checks has dropped to a terrific level, several enterprise companies still utilize checks to pay on a monthly basis to avoid the big piece of handling fees.

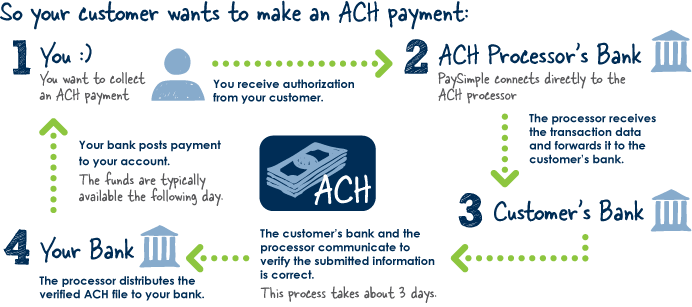

With ACH, given that the deal processing is recurring and also automatic, you wouldn't need to wait for a paper check to arrive. Because customers have licensed you to gather settlements on their part, the flexibility of it permits you to accumulate one-time settlements. No extra awkward emails asking consumers to compensate.

Credit card payments fall short due to different factors such as expired cards, blocked cards, transactional errors, etc. Occasionally the client can have exceeded the credit line and also that can have led to a decline. In instance of a financial institution transfer through ACH, the checking account number is used along with an authorization, to charge the consumer and unlike card purchases, the likelihood of a financial institution transfer failing is really low.

Excitement About Ach Payment Solution

Account numbers rarely transform. Unlike card transactions, financial institution transfers stop working only for a handful of reasons such as not enough funds, wrong bank account information, and so on. The two-level verification process for ACH repayments, makes certain that you preserve a touchpoint with clients. This factors in for churn due to unidentified factors.

This safe and secure process makes ACH a credible option. If you're taking into consideration ACH, head here to know how to accept ACH debit repayments as an on the internet service. For each and every charge card purchase, a percentage of the cash entailed is split throughout the various entities which allowed the payment (ach payment solution). A significant chunk of this cost is the Interchange cost.

In situation of a deal routed by means of the ACH network, since it directly deals with the banking network, the interchange fee is around 0. 5-1 % of the overall transaction.

More About Ach Payment Solution

For a $10,000 deal, you will pay (0. The cost for a common ACH deal varies someplace around 0. The real TDR (Transaction Discount Rate Price) for ACH differs according to the repayment entrance utilized.

Smaller transfer charges (usually around $0. 50 per transaction)Larger transaction costs (2. 5% to 3. 2% per purchase)Payments are not automated, Automated settlements, Take even more time, Take much less time, Process extensive as well as for this reason not as simple to utilize, Easy to use, ACH costs much less and also is of read this article fantastic worth to sellers however the difficulty is getting a multitude of users onboard with ACH.

They charge high volume (even more than $1000) users with only $30 flat cost for unrestricted ACH transactions. You can drive enhanced fostering of ACH repayments over the lengthy term by incentivizing customers making use of rewards and also benefits.

ACH transfers are electronic, bank-to-bank money transfers processed with the Automated Cleaning Home Network.

Ach Payment Solution Fundamentals Explained

Direct payments entail cash heading out of an account, including costs settlements or when you send money to another person. ach payment solution. ACH transfers are convenient, fast, as well as usually cost-free. You might be limited in the number of ACH deals you can initiate, you might sustain additional fees, and also there may be hold-ups in sending/receiving funds.

Getting your pay with straight deposit or paying your expenses online via your bank accounts are simply two examples find this of ACH transfers. You can additionally utilize ACH transfers to make solitary or repeating deposits right into an specific retired life account (IRA), a taxable brokerage firm account, or a university financial savings account. Local business owner can additionally utilize ACH to pay suppliers or get repayments from clients and also consumers.

Nacha reported that there were 29 billion settlements in 2021. That's a rise of 8. 7% from the previous year. Person-to-person and business-to-business purchases likewise increased to 271 million (+24. 9%) and 5. 3 billion (+21%), respectively, for the same period. ACH transfers have several usages and also can be a lot more cost-effective and also easy to use than composing checks or paying with a my blog credit scores or debit card.